Diversified Portfolio that Profits!

A Diversified portfolio or strategically mixed

portfolio will generally minimize losses but when in an emerging market, it will exceed

most expectations. This should tell you why?

Portfolios that are diverse are highly recommended for any investor to minimize risk of significant loss to investments. It is simply done by investing in different investment markets so that one would have an averaging effect of profits and losses. An example of a local coined term for having a diversified portfolio is “Don’t put all your eggs in one basket”. The justifying argument is that if you did that and dropped the basket all the eggs would be broken and lost. However, if you put each egg in a separate basket, the chances of all of them being broken will be low. As an individual stock for example can lose as much as 50% of its value at a time, it is not advisable to put all your money in any one stock, no matter the perception that it will go up even in the short term.

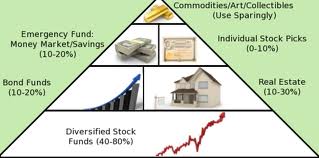

A diversified portfolio is generally recommended when investing in securities although the wisdom of it is applicable to all types of investments. Let’s review the approach called for using equities market. The idea is that you should diversify by buying as many different stocks in different industries and company sizes such that the negative effect of one industry that might affect some closely related industries will not affect all others hence there is an averaging win and loss to still hopefully give you a profit and hence a win. There are various approaches to the process of reducing this risk. Diversification is one and others would use shorting which focuses on the hedging of profit and losses of a security and by how much. There is available technical analysis used in establishing weighted averages of the stock portfolios and associated risks beyond the scope of this discussion. An investor’s risk appetite or how risk-averse he is, will also be factored into the types of investments selected. All in all, the goal is to mitigate losses and promote profit.

If there are many different types of investments out there and there is a methodical approach where you consistently do not lose your principal but consistently achieve industry expected returns and can mitigate the risk by diversifying into these different asset classes in order to follow good investment fundamentals, why not do this? This is the more logical approach it seems. To do this, one would be considering investments in emerging markets that provide more security simply because of the boom effect of the emerging market and secondly because of the security of the below asset classes as follows:

1. Real Estate – provides property as collateral

2. Mortgage Notes – Property mortgaged is the collateral

3. Multifamily units – property provided is a collateral

4. Tax liens – Local government guaranties principal and return

5. Offshore Private Equity Investments – Additional security generated by highest yields resulting from meeting high demands in low supply offshore environments

6. Offshore investments in Growth SMEs- High yields from introducing into the SME a mix of liquidity, optimized management plan and implementation

7. Direct Offshore real estate project Investments – Offshore real estate markets provide security and higher yields due to limited supply of property, infrastructure and liquidity.

Diversifying into the top 7 will compound your profits significantly because each market is uniquely secured allowing the recovery of principal and expected profit in its worst case when facilitated by an adept management team/ offshore agent (contact our adept team today). Yes you might say that some of the top 7 are not as liquid as in the stock market. Cash flow on income properties or dividend paying stocks might add a little liquidity otherwise mortgage notes will provide more liquidity within the top 7 and may be selected for the larger amounts in your portfolio.

The bottom line of maximizing profits and minimizing risk is to have a diversified portfolio utilizing the above-mentioned investments in the highest and most secured priority order for you. Lastly, a diverse mix of stocks, bonds and mutual funds can be added following use of the top 7 asset classes. The result will be strong realized compounding profits in symbiosis with lowered risk due to the application of good investment fundamentals. The team to help get you there is available now to get you onto a fast start to expected returns, feel free to contact our adept team today.

How to Invest > Where to Invest Money > Diversified Portfolio